Market update

U3O8 Spot: $48.25 per lb

LT U3O8 contract price: ~$50 per lb

UF6: $159 per kgU

Conversion: All time high of $38 per kgU

Enrichment: $91 per kgU

Cameco conference call

Cameco only contracted 5M lbs vs 40M in January 2022 for Q2. But Cameco states that they have “more lbs under discussion than we ever had since Fukushima”. Utilities are still lining up the rest of the fuel cycle before procuring U3O8.

Cameco also estimates marginal pricing to balance the market to have moved to $90 per lb.

Kazatomprom operations update

In the term market, contracting activity was substantially higher than in the previous year, with third-party data indicating that contracted volumes totalled about 71.5M lbs through the first six months of 2022, compared to about 37.5M lbs in the same period of 2021. The increase in term market activity resulted in an increase of the average long-term price by US$17.50/lb U3O8 year-over-year, to US$49.75/lb U3O8 at the end of the second quarter of 2022 (reported only on a monthly basis by third-party sources).

Demand side

EU

Nuclear is now added to the EU green taxonomy. While the optics are important, this opens new reactor projects to applying for ~350B Euros per year of low cost green financing. This is key since nuclear is capex heavy and interest rate sensitive. Major funds on an ESG obsessed continent can also now invest in the sector.

Belgium is in talks to extend 2 nuclear reactors by 10 years.

Poland wants to lease German nuclear plants, but now, Germany’s environment minister (from the anti-nuclear Green party) is now open to extending their reactors. Chancellor Scholz is now pro extension.

Dutch building 2 new power plants.

South Korea

South Korea will build 4 more reactors by 2030 and extend the life of 10 older units.

US

California budgets $75M to keep Diablo Canyon moving.

The Inflation Reduction Act of 2022, agreed to by Manchin and Schumer, would offer "zero emissions nuclear power production credit" for existing nuclear generators, beginning in 2024 and running through 2032. Additionally, the bill would provide $700 million to the Department of Energy to establish domestic supply of high-assay low-enriched uranium, or HALEU, the fuel that will be required to power the next generation of reactors.

Advanced Nuclear Reactors

Segra Capital recently put out a piece analysing the impact of advanced nuclear reactors on the uranium thesis. The key points relevant to the thesis I took away:

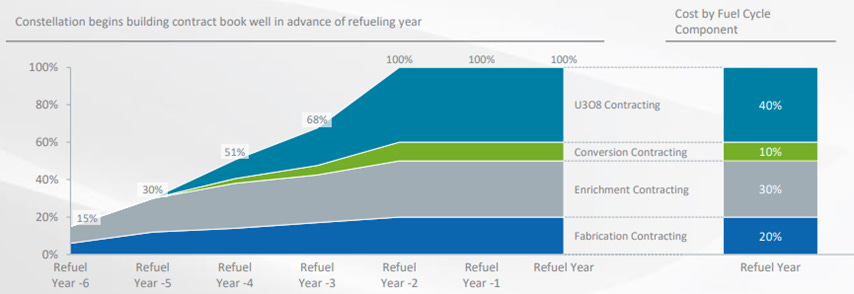

Uranium investors often think of advanced nuclear reactors as something for the next cycle. However, the impacts on this cycle will be tangible. Current forecasts (which will likely adjust upwards due to a nuclear revival) show initial build outs in 2020s, with major ramp up in the 2030s. Before reactor refuelling, U3O8 contracting can take place 3-5 years in advance. Constellation, the largest nuclear reactor in US, starts contracting 5 years before refuelling (Fig 1). This means that U3O8 contracting from advanced reactors will hit in the latter half of 2020s, exactly after we flex up capacity from mothballed mines and are in uncharted territory, against a wall of mine depletion, and when traditional build demand increases.

A lot of advanced nuclear reactor designs use HALEU, which is 5-20% concentration, vs <5% for LEU, which is what primarily powers traditional reactors. It’s way easier to upblend LEU to HALEU to raw feed stock, so we will likely see LEU being used to make HALEU, creating enrichment tightness for LEU. Also note currently we almost have no capacity in the west to create HALEU, Russia has almost all of that.

Many advanced nuclear reactor designs have huge front load requirements with less reload needs. Current reactors have an initial load of 3x annual demand. Terrapower’s Natrium Reactor will replace 1/7th of core every 24 months, meaning 14x annual demand (someone check my math if I’m doing this wrong). ARC-100 is supposed to run for 20 years without refuelling. That front loading demand is going to hit hard.

Supply side

Kazakhstan

Kazatomprom’s CEO resigns after less than a year in the role. Not sure exactly what this means, but such a short tenure is suspect…

Kazakhstan is separating itself from Russia. It has withdrawn from the 1995 Commonwealth of Independent States Agreement on the Interstate Monetary Committee, and is considering a ban on the transport of sanctioned goods to Russia and Belarus. As Kazakhstan’s uranium trade routes move through Russia and China, this threatens security of supply for western consumers.

Russian enrichment and overfeeding

A Canadian shipper has been granted a one year pass to continue to ship fuel from Russia to western utilities, but beyond that, the west is looking to wean itself off Russian fuel. On 28 July, a Full Committee Hearing by U.S. Senate Committee on Energy and Natural Resources was held to consider legislation to ban imports of Uranium from Russia and address US availability of HALEU fuel for advanced nuclear reactors.

In recent interview with Proven Reserves, he estimates that assuming we only have western SWU going forward and Japan restarts all their reactors (over 3 years), annual Uranium requirements will be 57M kilo tonnes vs 48M kilo tonnes produced last year, an increase of 19%.

HEU down blending

A potential short term dampening factor on this bull market that I may be underestimating is the down-blending of HEU (24M lbs of natural U308 equivalent for commercial use, 146M lbs for military) as a source of uranium supply. This has been hinted at prior:

Energy Intelligence understands that DOE’s Office of Nuclear Energy (NE) will procure at least 6 metric tons of HEU for downblending into about 25-30 metric tons of HALEU. It would be dedicated to DOE’s two Advanced Reactor Demonstration Program (ARDP) projects: TerraPower’s 345 megawatt sodium-cooled fast reactor, Natrium, and X-energy’s high-temperature gas-cooled reactor, the Xe-100

So it does appear that HEU could be down blended, but it appears to be for advanced reactors, with no indication on down blending to LEU for current reactors. This means that the increased interest in advanced nuclear reactors serves as a sort of insulation of the core thesis based on the LEU supply chain, as HEU down blending supplies are preserved/utilised for prospective HALEU supply.

Also note that it only brings forward supply, creating future demand for replenishment of stockpiles.

Company updates

Global Atomic

Construction of Phase 1 at DASA is progressing well.

Isoenergy

Good results.

Encore Energy

Signed more contracts, puttering along.

Summary

Contracting is picking up, with huge interest at Cameco and double the contracted amount in 1H2022 vs 1H2021 according to Kazatomprom.

Supply side remains constrained and Russian enrichment looks to be phased out asap, while demand continues to grow from extensions and new builds.

Advanced nuclear reactors look like an increasing likelihood and its impact will be felt this fuel cycle.

HEU downblending is a potential bear case in short term but merely pulls forward supply, kicking the can down the road. Also, HEU down blending is likely for HALEU, which means advanced reactor programs insulate the core LEU supply chain thesis from US stockpiles.

Nice summary article!

I had a question about CCJ, though admittedly I only read the transcript of the call. I took away they said the incentive U308 pricing was still in the mid 70’s and missed where they said it was in the 90’s?

Anyway, the fundamentals just keep getting stronger and stronger. We simply need global liquidity to come back into the market. Maybe after the fed pauses?