Dry bulk update and 2 ideas

Oil tanker's sister industry

I recently opened a significant position in Eurodry, a dry bulk micro-cap, so I thought I would cover the sector which has similar supply demand dynamics to oil tankers. I’ll go through the supply and demand side for dry bulk, and then discuss my new position.

Dry bulk basics

Dry bulk ships carry heavy commodity cargo. Bulk carriers are segregated into six major size categories: small, handysize, handymax, panamax, capesize, and very large. Very large bulk and ore carriers fall into the capesize category but are often considered separately.

Based on 2019 figures, global cargo breakdown by volume x duration is 58% iron ore, 20% coal, 8% grain, 9% minor and 5% bauxite. Iron ore is carried mostly on Capesize (which also carries a little bit of coal). Other commodities are carried on smaller vessels, with a smaller portion of coal and grain but higher portion of minors as ship size decreases.

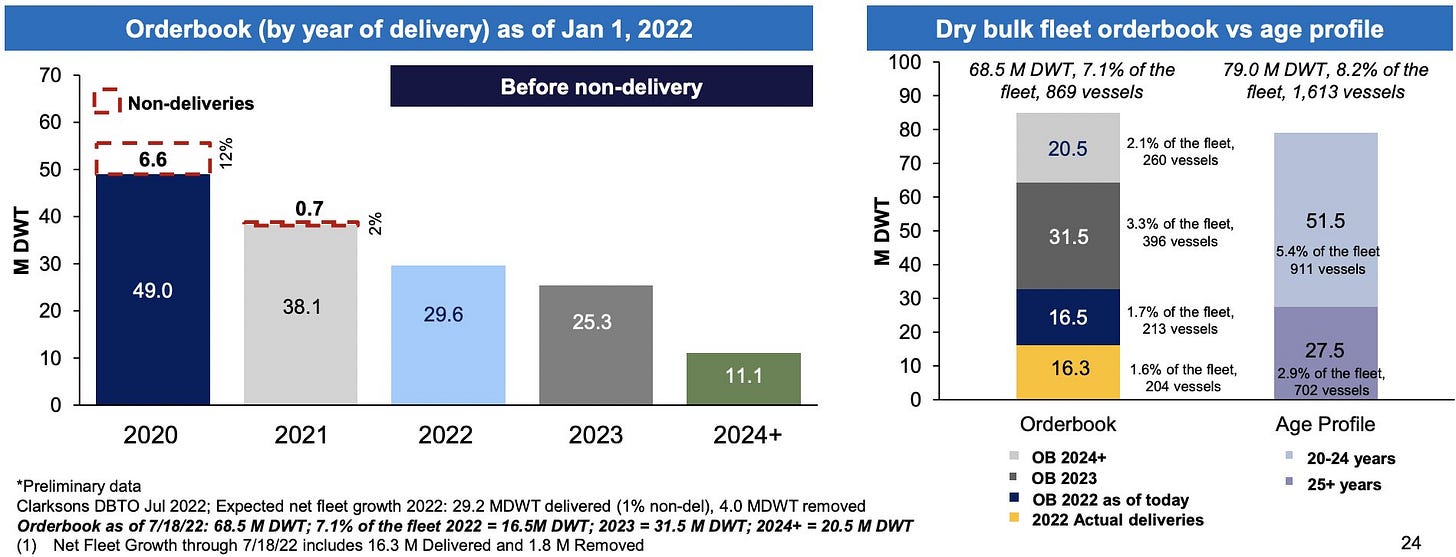

The supply situation for dry bulk is similar to oil tankers. The current order-book is at multi decade lows (Fig 1), while shipyard slots are full through 2026. The fleet is not young, with Capesize fleet age at 9.4 years in 2021, compared to 10.1 years for oil tanker VLCCs in 2021. The incoming orderbook for rest of 2022 to 2024+ is actually less than the number of vessels over 20 (Fig 2). The scrapping age might be slightly higher (23.3 vs ~20 in 2018 for Capesize vs VLCCs, for e.g.), so imminent scrapping is more muted, but the projection is for average fleet growth of 1.8% for 2022 - 2025 (Fig 3), which is well below norm.

Demand side

The Baltic Dry Index (BDI) is the composite indicator of dry bulk rates. Rates surged to 5670 in October 2021, the highest rate since September 2008. The surge was primarily due to the COVID reopening leading to manufacturing resuming. However, due to the staggered nature of the reopening, vessels were often in the wrong place to meet demand, causing port congestion. In Oct 2021, about % of the dry bulk fleet was waiting offshore due to lock downs in some Chinese cities. Soaring fuel costs also forced shipowners to raise rates.

However, rates have fallen recently due to easing congestion and renewed lock downs and economic weakness causing lower coal and iron (primarily) demand.

The future outlook for demand is dampened by recessionary fears, but Chinese reopening and stimulus would move rates higher. However, the situation on the lock down easing looks unclear, and stimulus is unlikely to be major, but they remain upside risks. Meanwhile, upcoming sanctions against Russian coal, which coincides with coal plants being restarted, will lead to seaborne imports from far-off places like Australia, which would greatly increase ton miles Late July is also the seasonal low point for dry bulk.

Sector thoughts

Overall, the BDI has pulled back sharply and the near term outlook looks uncertain with recession, continued lock downs and weak stimulus. But there are factors that could lead to a reversal in rates. That said, dry bulk stocks have pulled back sharply and are looking inexpensive.

Idea 1: Eurodry

Eurodry is a small dry bulk company. Based on 1Q22 financial statement and recent corporate presentation:

2847091 shares basic, 2879436 shares diluted, share price US$17.46 as of July 28th 2022, for market cap (basic) of 49.71M.

18.64M current assets (11.4M cash and cash equivalents), 147.7M fixed assets, 169.1M total assets, 17.6M current liabilities (11.9M debt payments), 62M long term liabilities (debt), for total asset - total liability of 89.6M.

Operating 9.5 ships in 1Q22, they generated 10.5M net income, 9.5M adjusted for derivative losses.

Now have 11 vessels (+15.7%) at average age 13.5.

Company trades at 55.46% of net asset value, with 1Q22 net income that if annualised would be 42M. It has 11 vessels now instead of 9.5. While rates could weaken further, most of the selloff is done (barring a severe recession). There are also reasons for a reversal. Management has a 30% stake, and they are looking to grow their fleet. With the dry bulk outlook in coming years, I think there is significant upside for Eurodry ahead (which traded at US$42.75 in April 2022). While tankers have a better imminent outlook, I see current valuations attractive. Any weakness is an opportunity for accumulation.

I initiated a position of 600 shares @ average price US$16.37

Idea 2: NMM

NMM is the second largest shipping company with a US listing by fleet size. It has 30,197,087 common shares outstanding which at share price US$28.72 on Jul 28 2022 equates to 867.26M market cap.

It owns 45 dry bulk vessels, 37 container-ships, 41 tankers, with 17 to be delivered (12 container-ships, rest dry bulk/tankers). It has 7 chartered vessels operating (3 dry bulk Panamaxes, 4 tanker VLCCs) and 5 chartered vessels to be delivered (all dry bulk Capesize). On Jul 26 2022, NMM acquired a 36-vessel dry bulk fleet for a gross purchase price of $835.0 million, consisting of 26 owned vessels and 10 chartered-in vessels (all with purchase options). This was done with purely cash/debt (debt 441.6M). This gives it an estimated NAV >$100 per share, meaning the stock is <30% of NAV. This also means closing the P/NAV discount to 40% results in a price target of $56.

For Q2 2022, it has US$$118.2M net income. However, considering the 36 vessel acquisition and current rates, company can expect to earn its entire market cap in free cash flow over the next 12 months.

Company also announced a 100M buyback authorisation.

Management owns 5.4% of the company, whilst Navios partners owns 10.5%.

With strong chartered earnings for container ships, an imminently stronger tanker market, a long term stronger dry bulk outlook, good management signalling to shareholder value and most importantly cheap valuation relative to NAV and cash flows (cheaper than peers due to historical scepticism over returning profits to shareholders), NMM has a good outlook, with some part of the discount to peers in terms of NAV likely to be closed.

I initiated a position of 100 shares @ average price US$28.05